Navigation Redesign

Rooms To Go

Project Overview

Rooms to Go asked for outside expertise for reasearch and ideation for their internal UX team.

MaxMedia’s UX design team has a particular skill set in digital and physical integration with a majority of the team having an architecture background. MaxMedia’s assignment was to step in and help with a range of projects.

This case study covers the process of redesigning the navigation.

-

Rooms To Go

-

8 weeks

-

UX Designer

-

User Research & Testing

Wireframing

Prototyping

Design Presentations

Research & Discovery

What are the primary objectives?

Increase “findability” for both the digital resident and the digital visitor user. The digital visitor is more likely to use the navigation to find an item where the digital resident is more likely to use search.

Utilize more imagery in the navigation. Opportunities to use more category and design inspiration photos as well as iconography for way finding.

Focus customer on the navigation items. Need more hierarchy in text styles and overall better use of whitespace.

Increase interaction with embedded concepts in RTG brand. Bring appropriate attention to “Shop by Room” feature as well as the featured collections.

What are the current pain points?

Too many sub categories

Not enough main categories

Long lists of items; no text hierarchy

What do we need to know?

-

Simplicity: avoid clutter

Websites with simpler designs have higher conversion rates

Too many categories will confuse the user; use broad terms to categorize the products

Get rid of ads

82% of shoppers in the U.S. say online ads are disruptive

Flexibility: accept as many payment options as possible

All credit cards, PayPal, Apple Pay, payment plans

Make sure all products are clearly and appropriately labeled

Offer free shipping

Unexpected costs are the top reason for cart abandonment

Transparency: informative product descriptions

But keep it concise

Easily accessible customer service

Partner with brand influencers

Establishes credibility to drive sales

High quality product images

Video demonstrations. 90% of consumers say videos help them make a decision about purchasing a product

Feature customer reviews and testimonials

-

Digital Inspiration: be visible

Discovering new products and finding inspiration

Hoping to be excited by what they see

Stumbling upon inspiration when they’re not looking for inspiration

70% of consumers purchased from a brand after seeing a video on YouTube

Show up through out the purchase journey with clear information on products, services, and availability.

Supportive Spending: take a stand

Shoppers putting their money where their values are

Sustainability, recycling, cruelty free, etc

Searches for “ethical brands” and “ethical online shopping” grew 300% and 600% year over year in 2020, respectively

Wear your brand values like a badge of honor

Be as detailed as possible, consumers are getting more sensitive to greenwashing and superficial statements

Give people a reason to support you and find authentic ways to follow through

Convenience: be flexible

Curbside pick-up and same-day delivery became staples for many people

Global searches for “along my route” (+1000%) and “curbside pickup” (+3000%)

Convenience became a key differentiator

Beyond location and availability retailers have been tapping into innovative services like virtual try-ons

Provide choice and flexibility in your delivery and collection options

Dynamic Demand: embrace change

Increase in searches for hobbies and new habits

Searches for “candle making kits” rose 300%

Searches for “patio heaters” rose 600% as people moved outdoors

Use insight tools to stay in touch with consumer signals

Prepare for rapid, short term shifts in demand

-

Baby Boomers: born 1946-1964

Prioritize convenience above all else

Significantly less likely or willing to explore a store for new products

With a greater amount of disposable income, Baby Boomers are not searching for the best bargain, which is a greater characteristic of Millennials and Get Z

Baby Boomers are very comfortable browsing and shopping online with 66% of Boomers reportedly making regular purchases on the web.

Baby Boomers by far prefer the personal engagement of traditional stores

Gen X: born 1965-1980

Gen X is often referred to as the “middle child” generation due to its reputation of being forgotten by marketing specialists. Because of this there is little market research into their spending habits.

Gen Xers tend to shop more conservatively than other generations

More skeptical of marketing tactics, Gen X won’t purchase a product until they’ve researched it thoroughly

Make extensive use of search engines, online reviews, and social media networks before making a purchase

Millennials: born 1981-1997

69% of Millennials demand the convenience of omnichannel accessibility. Having an experience that can transition their consumer data from their smartphone, to laptop, to local store, and back again

82% of Millennials say word-of-mouth is a key influencer in their purchase decisions

Skeptical of overbearing marketing tactics and reject retailers who constantly push

Sees shopping as a social activity (Millennials largely see shopping as fun and relaxing)

Gen Z: born 1998-2010

Generation of digital natives who cannot remember a time before the internet

While much of their research is digital, Gen Z still prefers to shop in-store and see it as a social activity

Technology and social media presence drives Gen Z’s shopping experience

Gen Z is likely to contribute to consumer-generated content for brands

Providing consumer-generated content is crucial for retailers to reach this generation

Site Visit: 3 retailers

Rooms To Go

What was successful:

Sales staff were attentive and knowledgeable about show room products

What could use improvement:

Product sales sheets are difficult to understand

Too many options/products to look at; hard to make a decision while in the store

2. Interior Define

What was successful:

Creating “rooms” with a small, open floor plan

Showcases customization options without overwhelming the shopper

What could use improvement:

Limited options and configurations in the store

3. Restoration Hardware

What was successful:

A lot of interior design thinking is done for you

Easy to imagine living in the spaces they’ve created

What could use improvement:

Very overwhelming experience; impossible to see everything

RTG Focus Areas

Decision Making

Showroom is very product heavy; it’s hard to remember what you’ve seen

Hick’s Law

The time it takes to make a decision increases with the number and complexity of choices available

Customization & Product Sheets

Product sheets and room set descriptions are difficult to understand even before customization is considered.

In-Store Availability

Automatic alerts and features in place to make sure your local store has the items you’d like to see in stock before arriving.

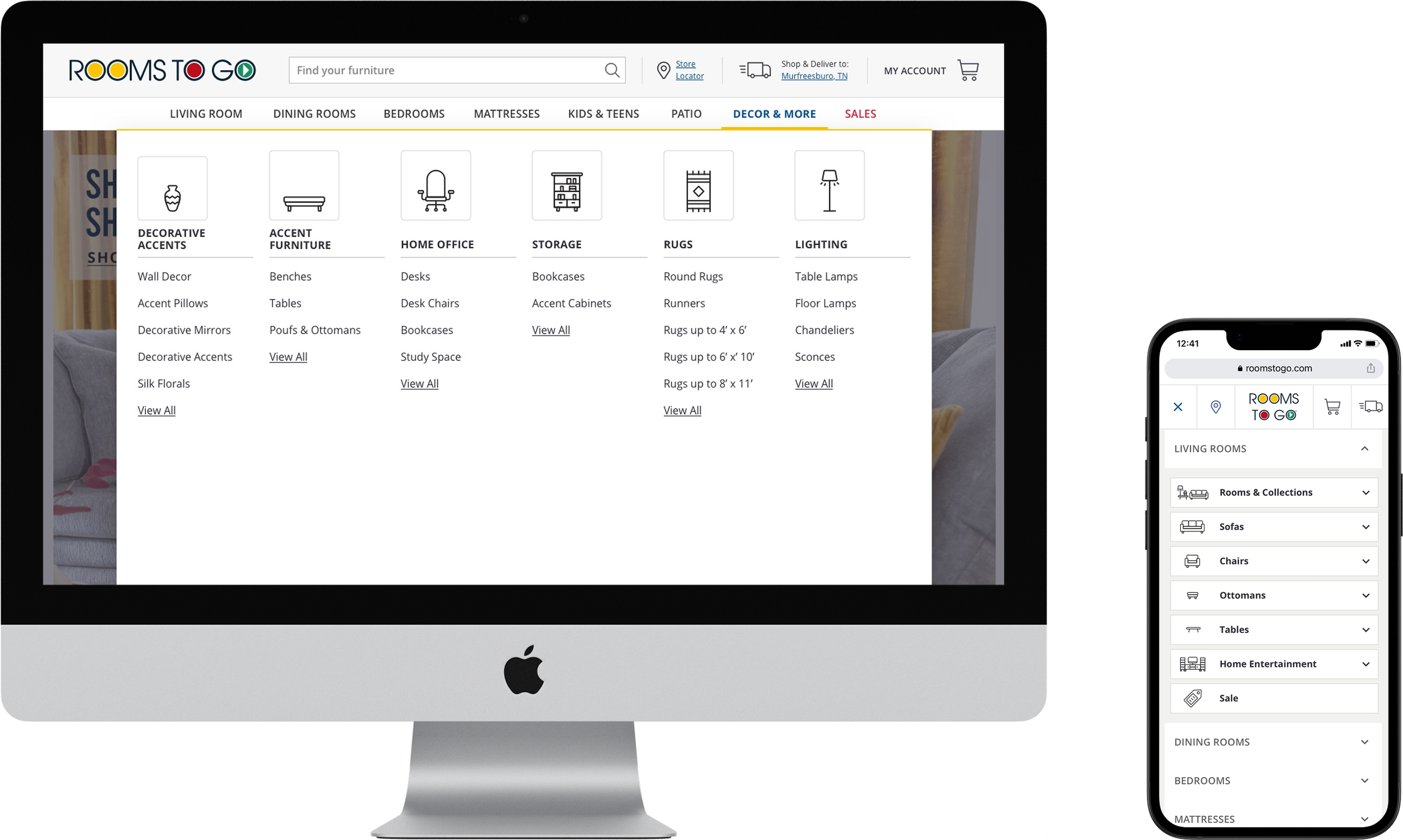

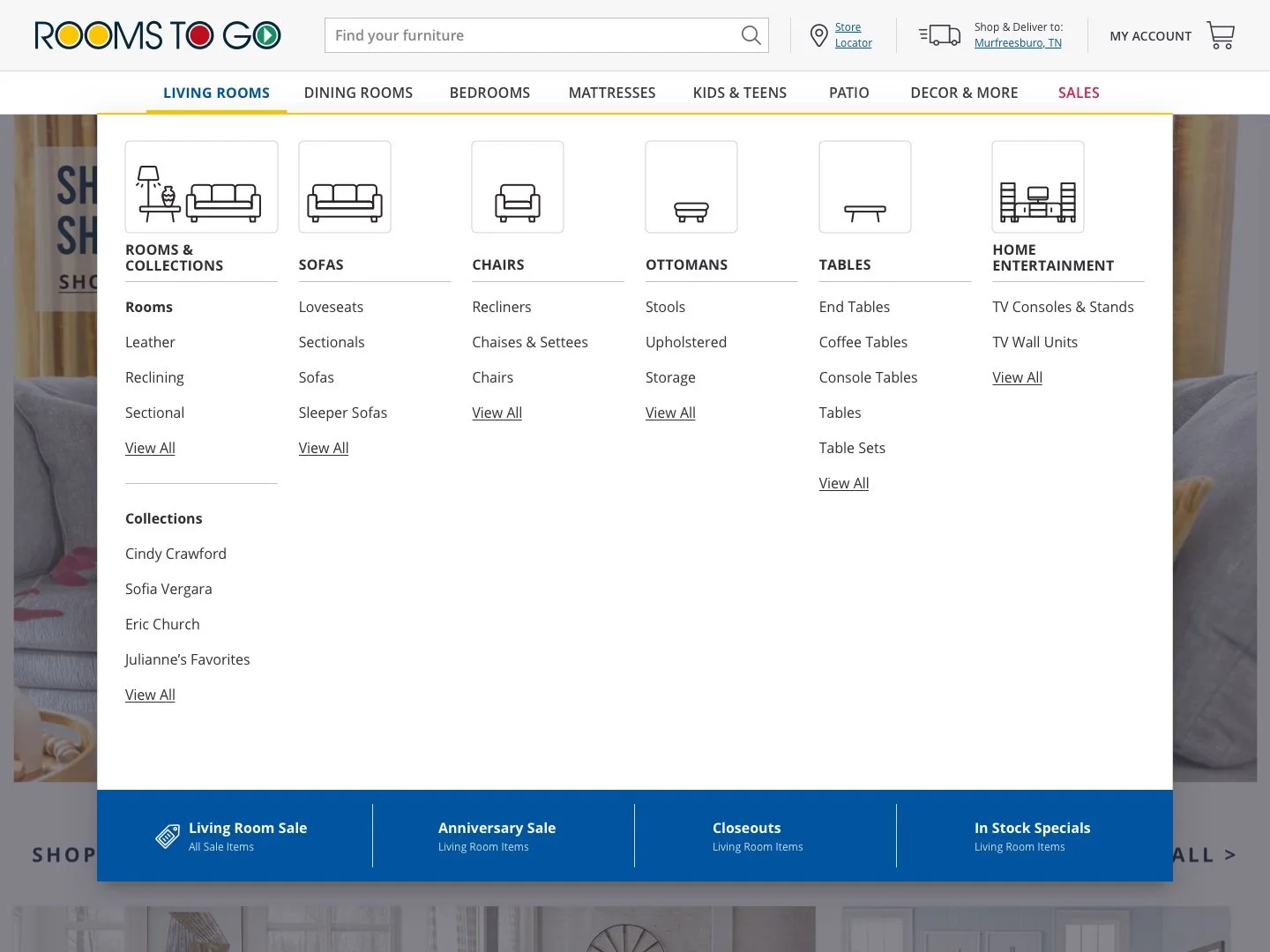

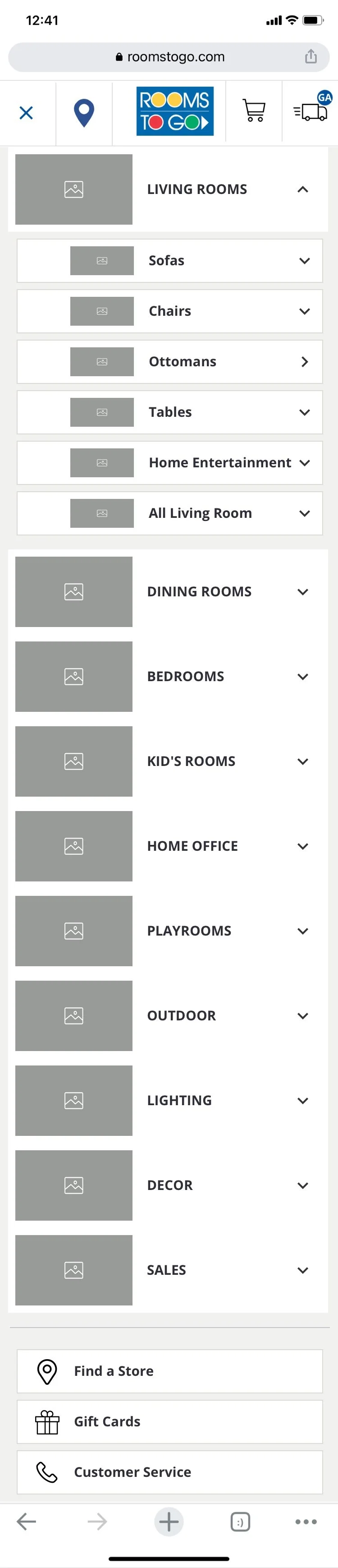

Existing Conditions

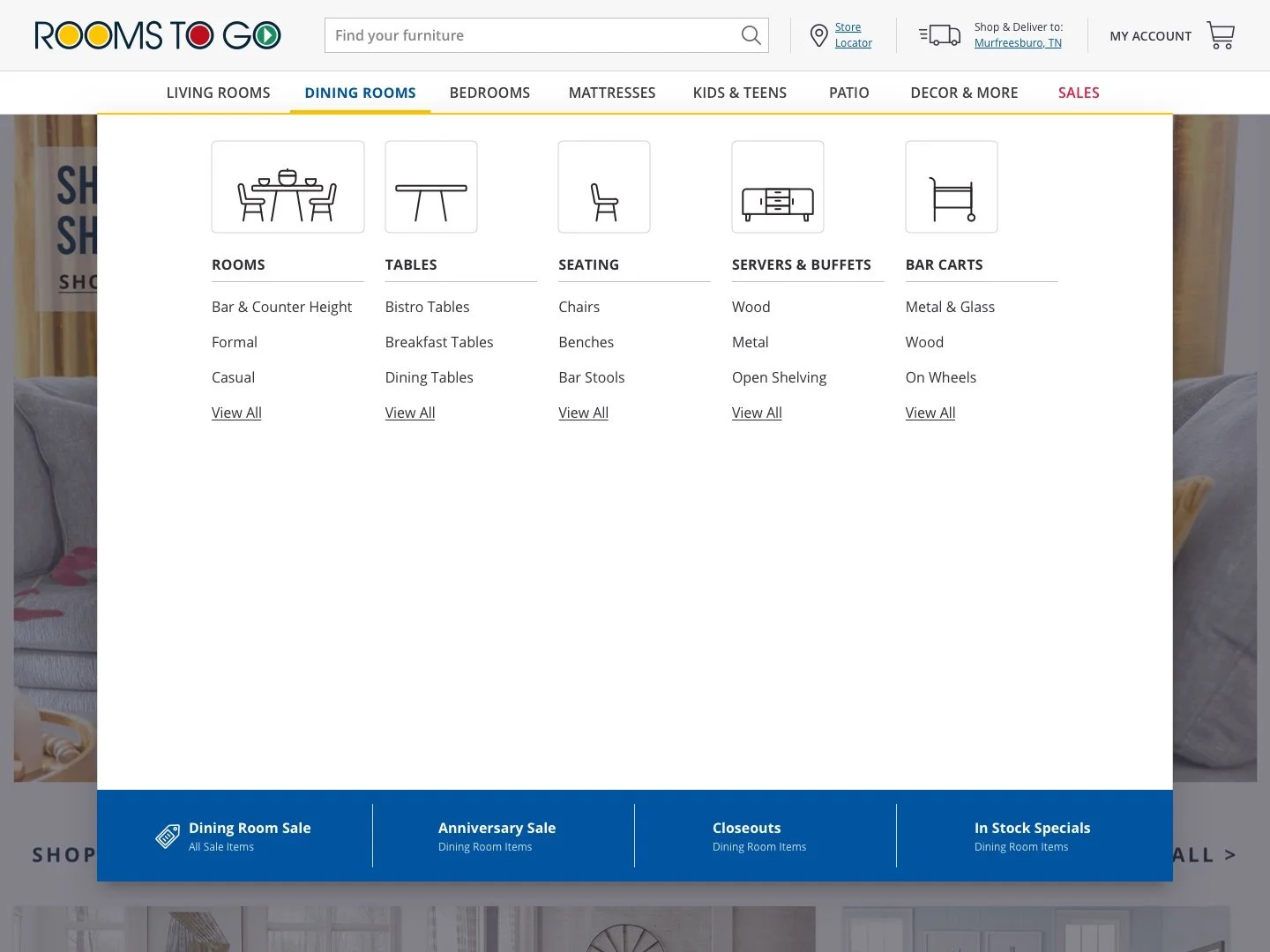

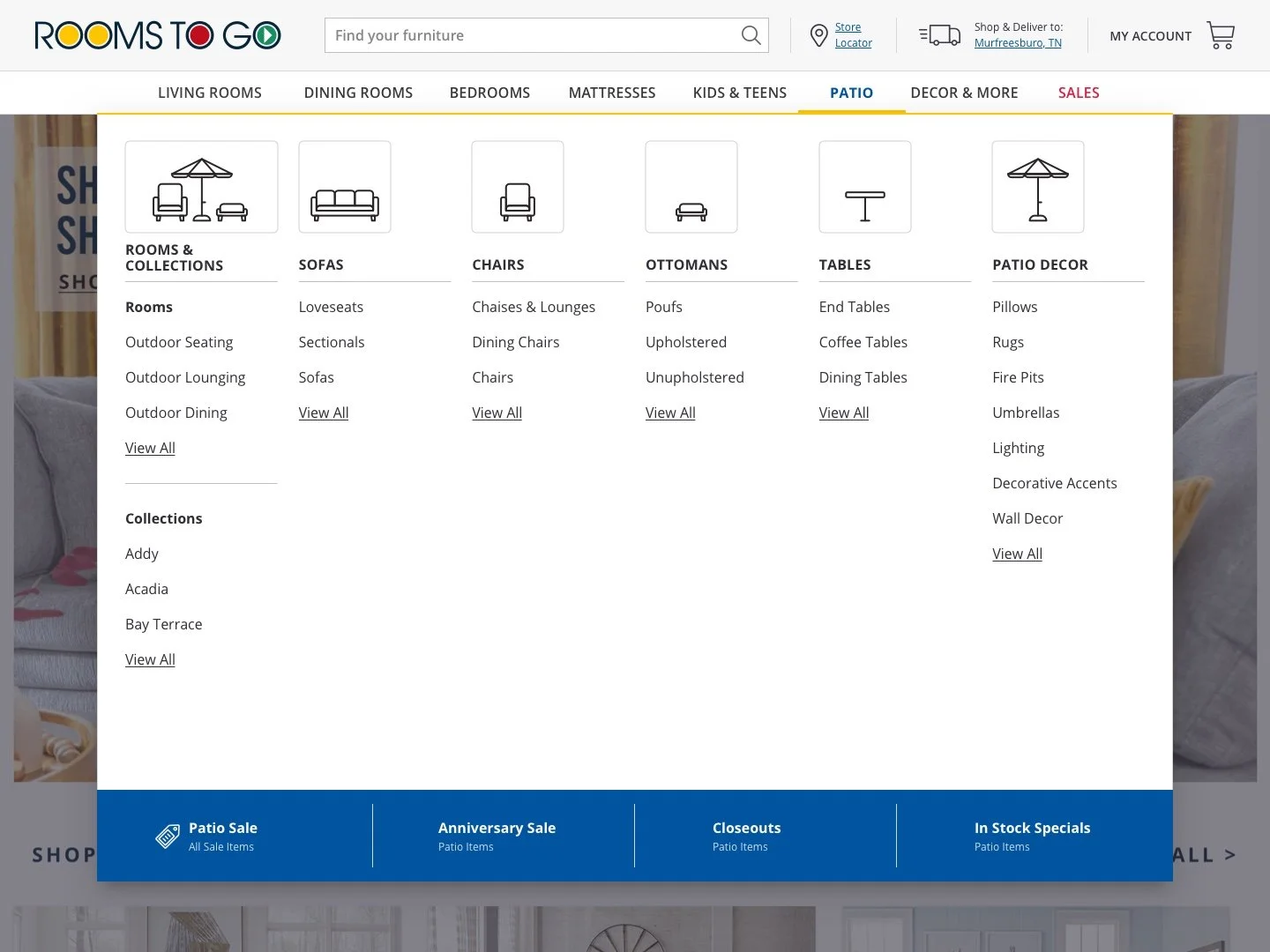

Navigation is accessed by main double header with corresponding drop down menus. While the menus are more concise than other retailers the lack of text hierarchy makes scanning the subcategories difficult. The drop downs could benefit from some layout reorganization to eliminate the existing trapped white space.

Search bar is located at the top center of the browser window and was often hard to find in user testing. The immediate search results are only text related; no visuals.

Filtering is located on the left hand side of the PLP and gives a wide variety of filtering options.

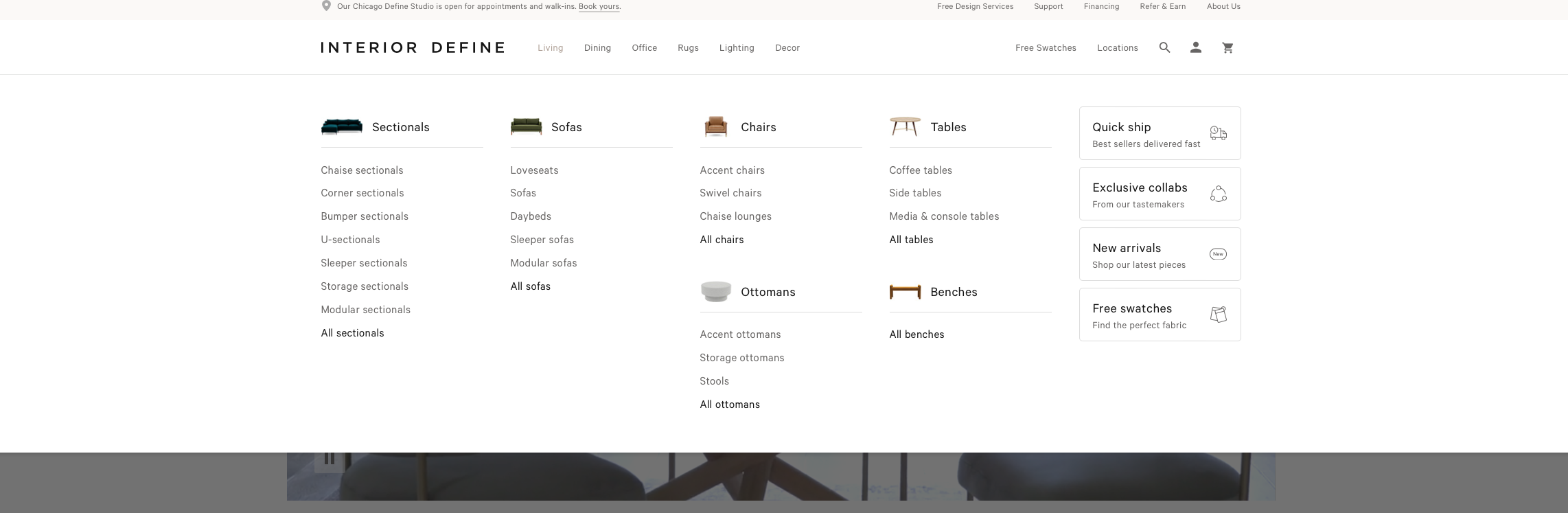

Comparative / Competitive Analysis

A comparative / competitive analysis was done for 6 other furniture retailers.

Navigation, search, and filtering options were reviewed and analyzed for all 6 companies.

Testing

Objective

To verify the design team is moving in the right direction the usability of 3 differing navigation and search styles will be compared along with 2 major buying demographics.

Testing Plan

Ask participants to find a specific item as well as the last thing they bought for their home on each of the sites.

See below documents for more detail.

Intended Outcome

Show the benefits or disadvantages of simple and detailed navigation menus with the 2 major buying demographics. Information collected from this will inform the final search and navigation design.

Testing Sites

CONTROL: Rooms to Go

DETAILED: West Elm

Testing Groups

Baby Boomers

60-80 year age range

Has shopped for furniture multiple times for multiple homes/environments

4 users tested

SIMPLE: Interior Define

Millenials

20-40 year age range

Is starting to shop for furniture or has furnished their first living space on their own

3 users tested

Testing Results

Baby Boomers

60-80 year age range

Has shopped for furniture multiple times for multiple homes/environments

4 users tested

Millenials

20-40 year age range

Is starting to shop for furniture or has furnished their first living space on their own

3 users tested

Ideas Confirmed

Baby Boomers reacted positively to a more detailed navigation

Millennials found the simpler navigation easier to use and didn’t like the complexity of Rooms to Go or West Elm

Millennials felt the Rooms to Go site was “cluttered”

Baby Boomers and Millennials liked the incorporation of product images in the nav

New Discoveries

Baby Boomers relied on product images to make decisions and were very visual

Millennials were drawn to inspiration images to make decisions

Baby Boomers only noticed the search bar when it was on the left side of the screen

Millennials wanted more text differentials/hierarchy in the more complex navigation menus

Design

Concept Design

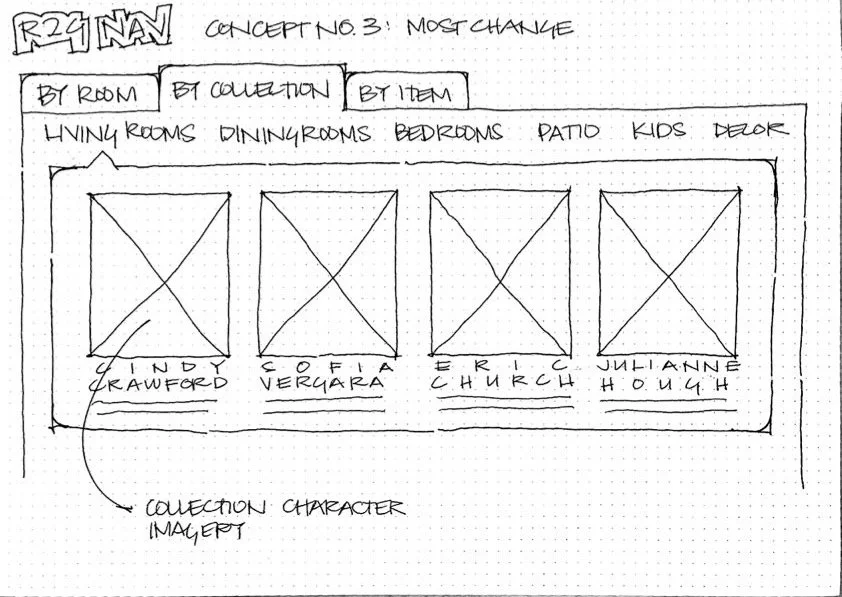

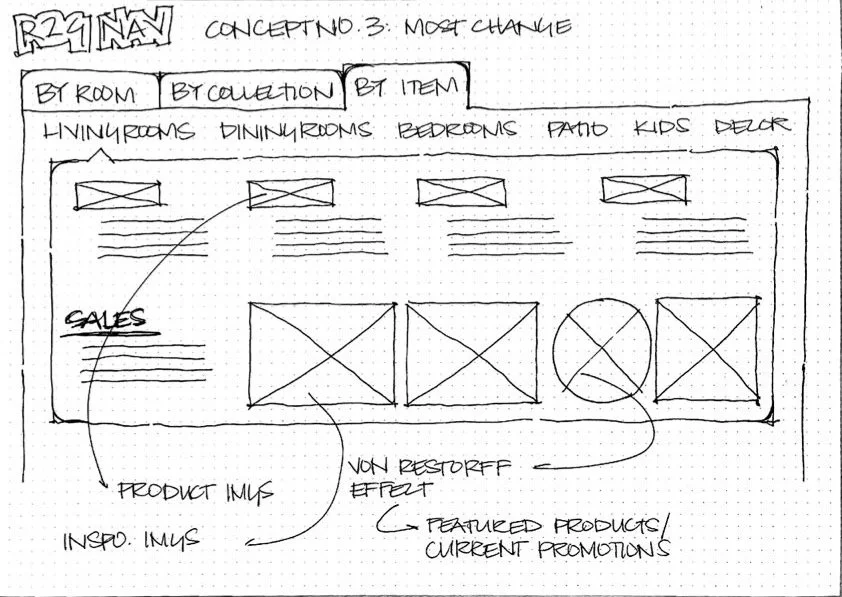

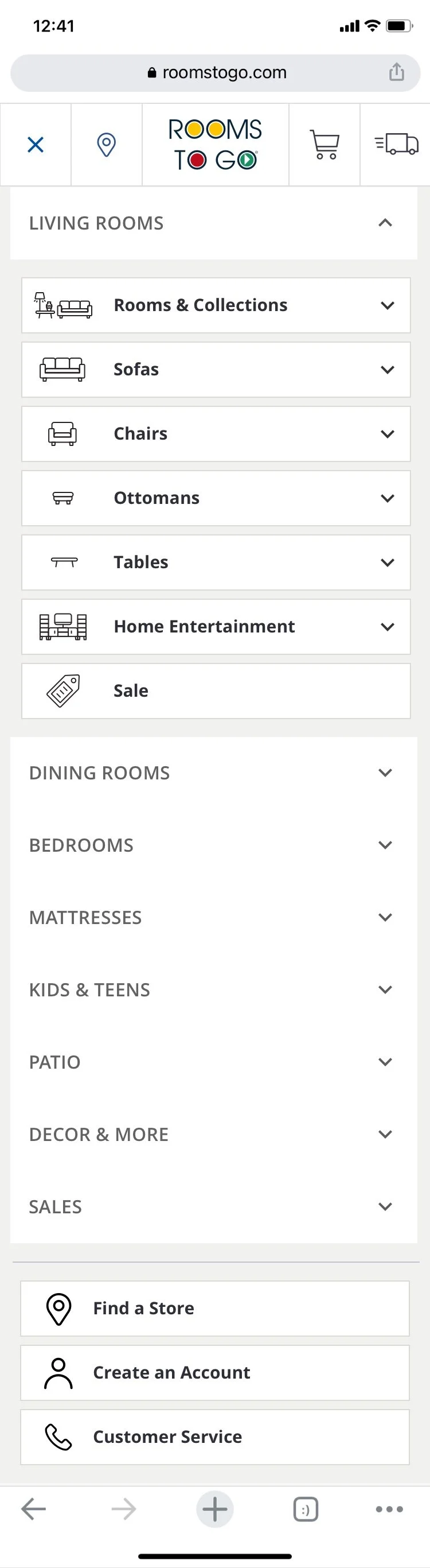

Concept 3: Most change

Shop by Room

In this concept three ways to shop for furniture have been determined: room, collection, and item.

Shopping by room will provide inspiration imagery to help direct customers to the type of items they are most interested in seeing based on their design style.

The Von Restorff Effect will be used to direct a customers attention to specific imagery for a featured product or current promotion.

Design Development

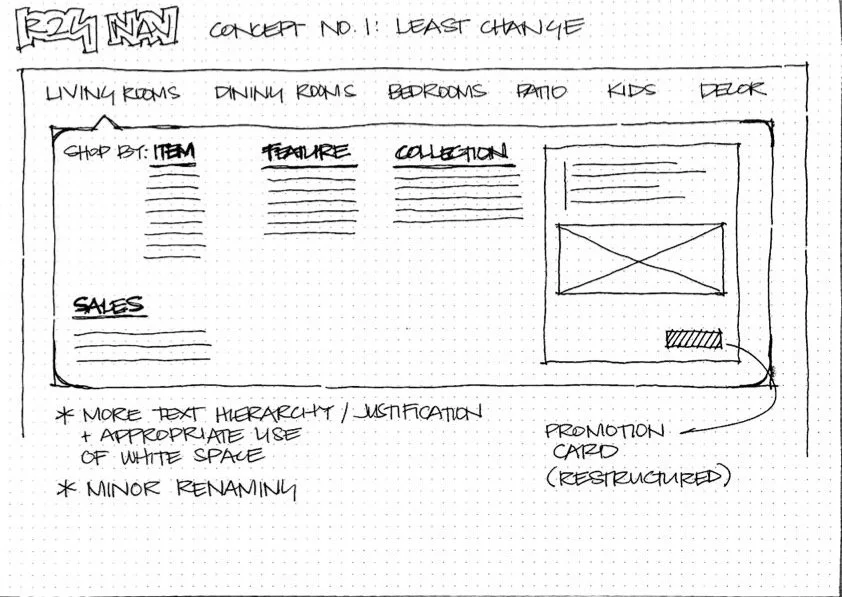

Concept 1: Least amount of change

This concept shows a version of the navigation that most closely resembles the current design and layout.

By incorporating more text hierarchy and minor product renaming the panel becomes easier to take in and understand. Adjusting the layout of the promotion card also creates a more seamless experience.

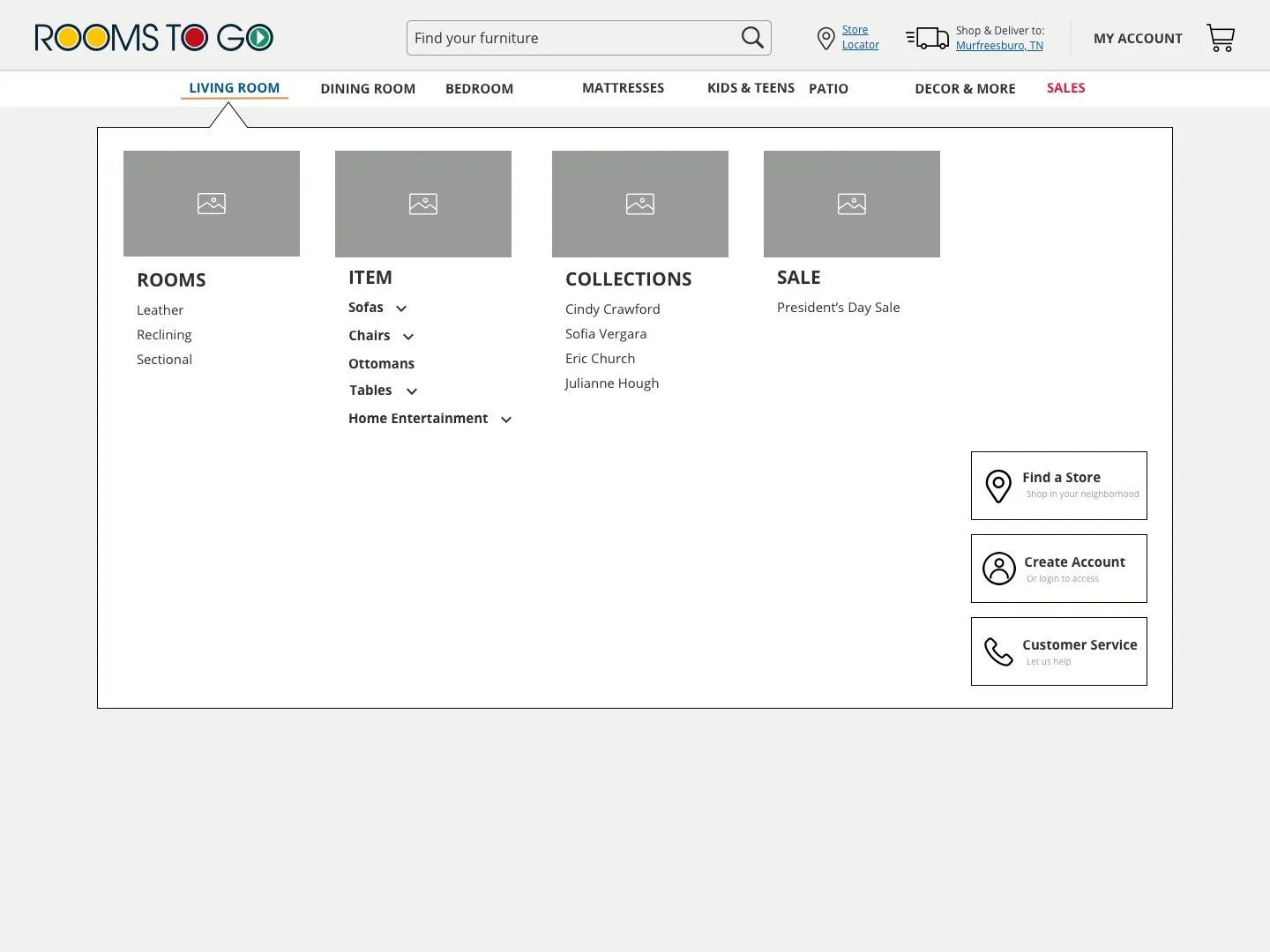

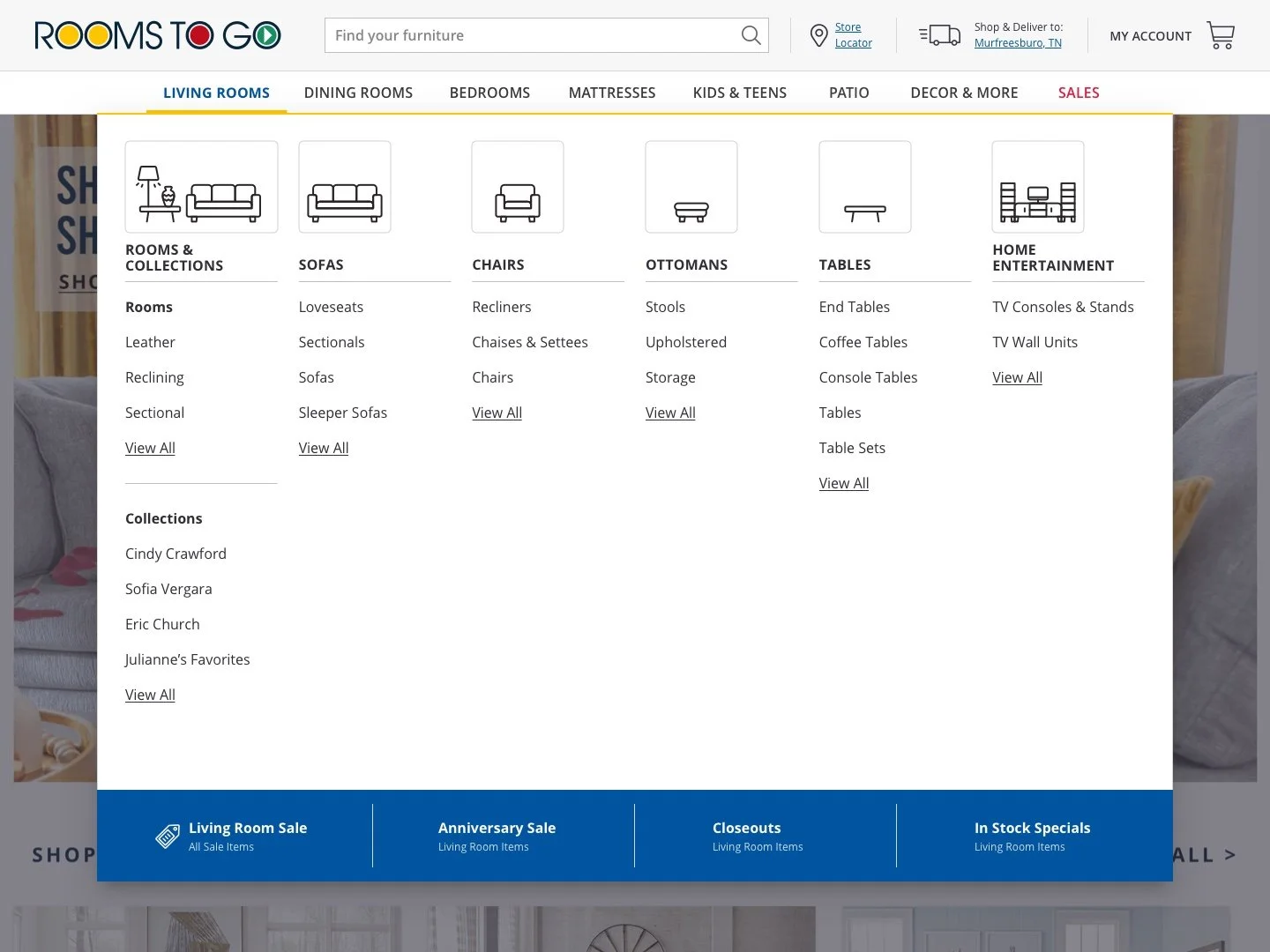

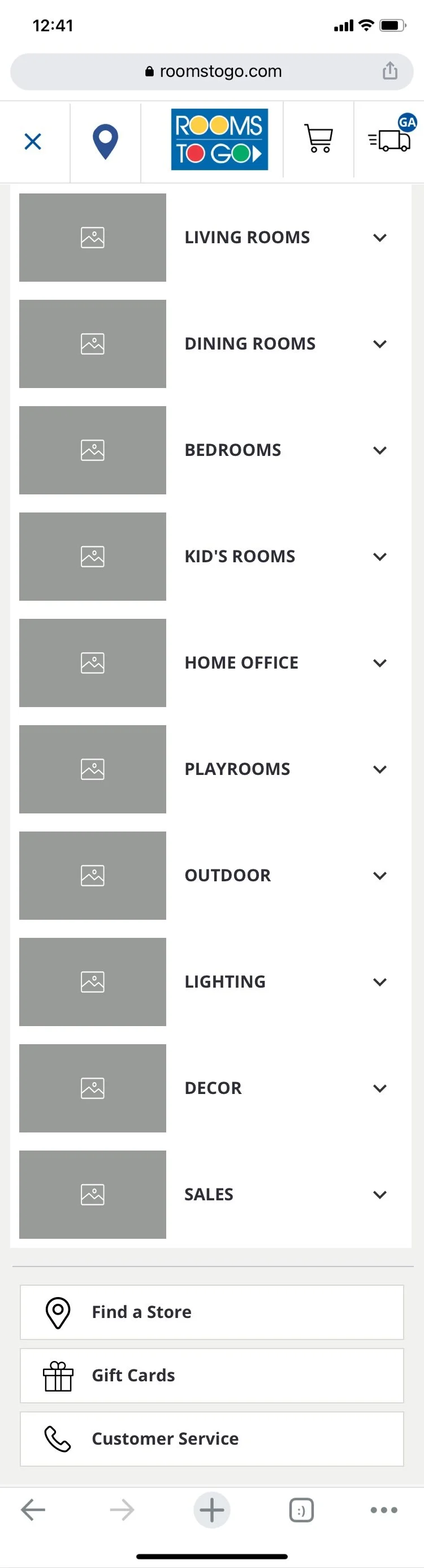

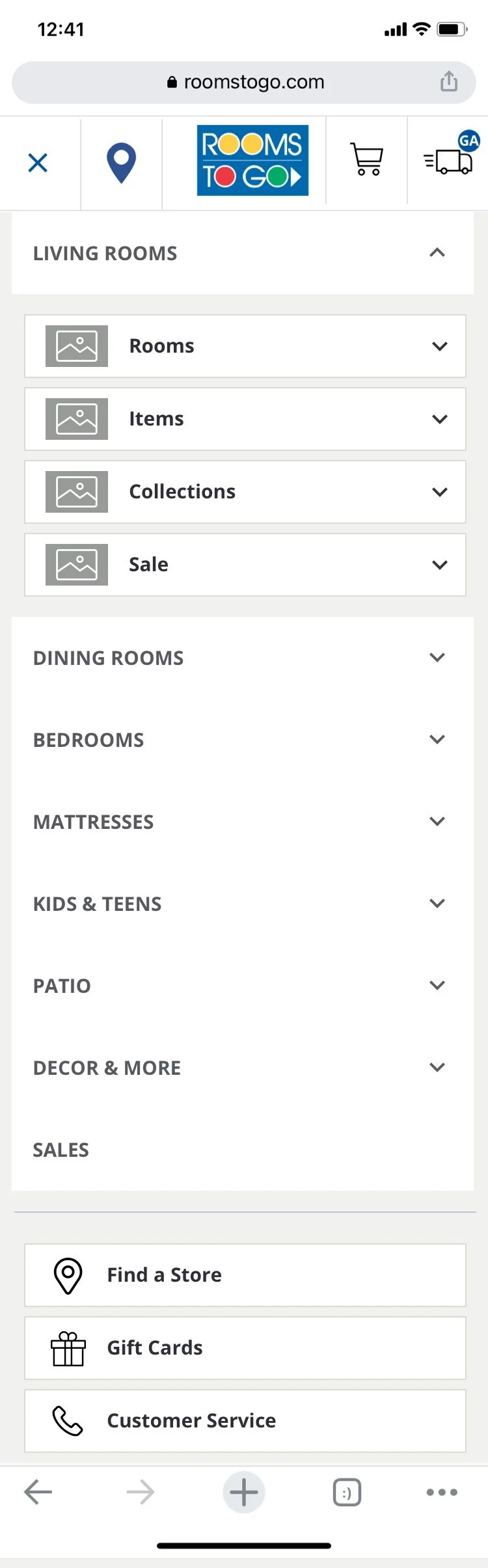

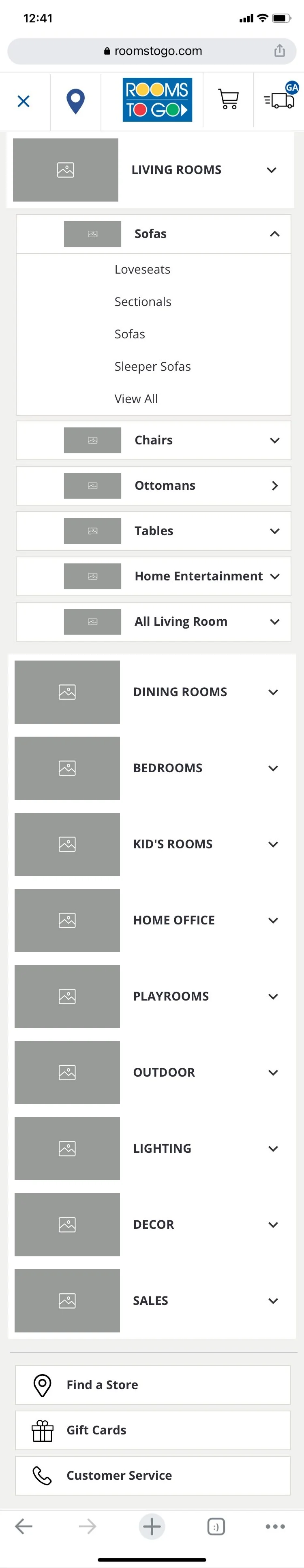

Concept 3: Revised

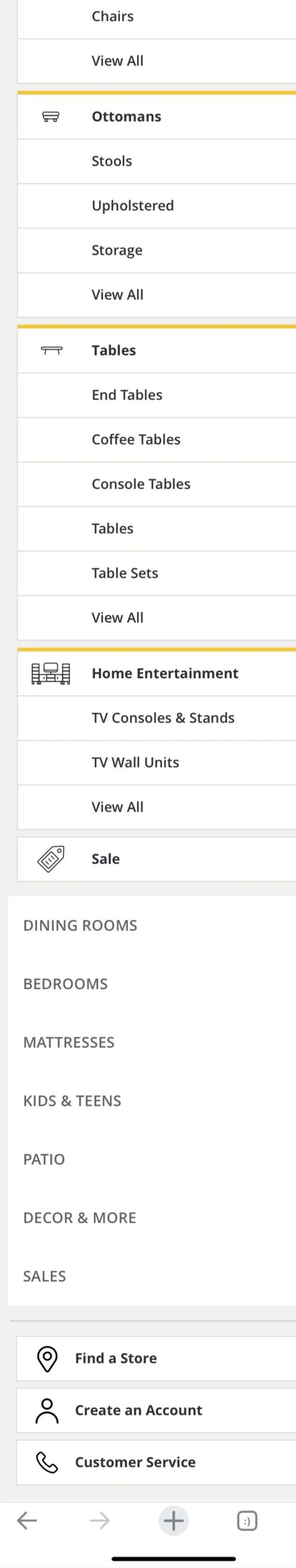

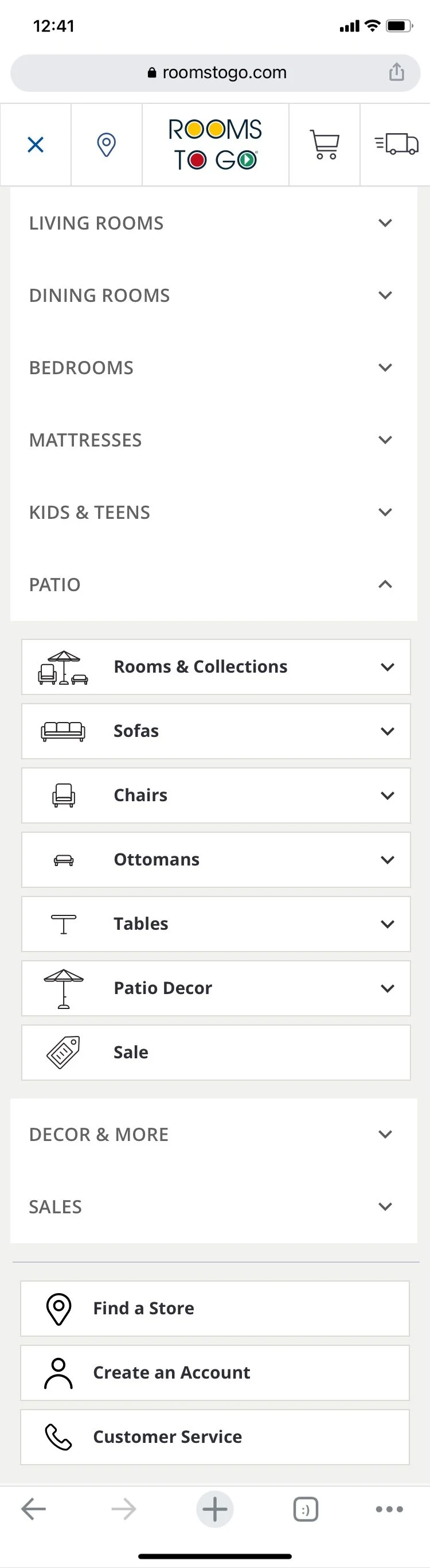

This version of the navigation, for both desktop and mobile, still uses imagery components, category consolidation, and minor renaming from the previous version but it has been reorganized to include more information upfront.

Drop down menus were eliminated and categories were added and rearranged to fit everything comfortably.

Features buttons for a store locator, account creation, and customer service were moved to the base of the navigation menu.

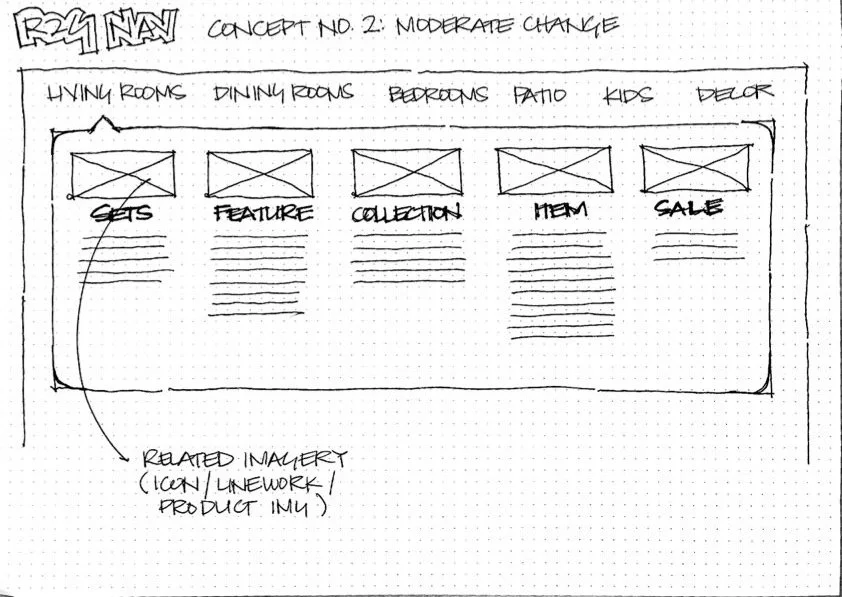

Concept 2: Moderate change

This concept shows a version of the navigation that has a moderate amount of change that isn’t dissimilar from the current navigation but does involve a restructure.

By introducing visual components customers will be able to interpret the navigation menu quicker to find what they are looking for. This concept also includes minor product renaming in an effort to consolidate.

Shop by Collection

In this concept three ways to shop for furniture have been determined: room, collection, and item.

Shopping by collection will show available or featured collections for each room type with a promotional image for each to give customers a sense of what the collection will look like.

Kids & Teens

Shop by Item

In this concept three ways to shop for furniture have been determined: room, collection, and item.

Shopping by item will show both product specific images for the main navigation categories as well as inspiration imagery for those who would like it.

The Von Restorff Effect will be used to direct a customers attention to specific imagery for a featured product or current promotion.

After presenting all concept sketches the team moved forward with concept 2 and 3 with some changes.

Concept 2: Revised

This version of the navigation, for both desktop and mobile, uses the imagery component, category consolidation, and minor renaming from concept sketch 2.

Drop down menus were incorporated in order to reduce the visual load of all the items listed out.

Features buttons for a store locator, account creation, and customer service were added.

Mattresses

The final design of the mobile navigation uses the same iconography from the web design to create a seamless experience and help customers visually navigate the menu.

Text hierarchy easily shows primary vs. secondary information and provides a visual break in the longer lists of items.

The yellow accent appears for expanded menus to help customers orient themselves.

Living Room

Mattresses

Living Room Icon Set

Bedroom

Patio

Final Designs

The final design of the navigation uses iconography as a quick and simple way for customers to scan the navigation menu to find what they are looking for.

Text hierarchy easily shows primary vs. secondary information and provides a visual break in the longer lists of items.

The banner at the bottom of the menu gathers all sale information.

Dining Room

Living Room

Dining Room

Kids & Teens

Patio

Bedroom